Are you a Sole Trader or Partnership? You will likely have heard that the Making Tax Digital scheme is coming into view from April 2026 and a key action step towards this is basis period reform. The financial year ended 5 April 2024 is now the Basis Period Reform transitional year. Once the transitional year is past, unincorporated businesses will then be taxed on profits falling between the 12 months from 6 April and 5 April (or 1 April to 31 March if that’s preferable).

For most, your accounting period perhaps already runs from April to March and will therefore slot in nicely when the new regime comes into play. For those sole traders or partnerships whose accounting periods do not run from April to March, it is now time to follow the phased change, beginning with your tax return covering the year ended 5 April 2024. In the spirit of proactivity, here’s our useful, step-by-step guide to help you get your head around the transitional year for Basis Period Reform.

How does basis period reform work?

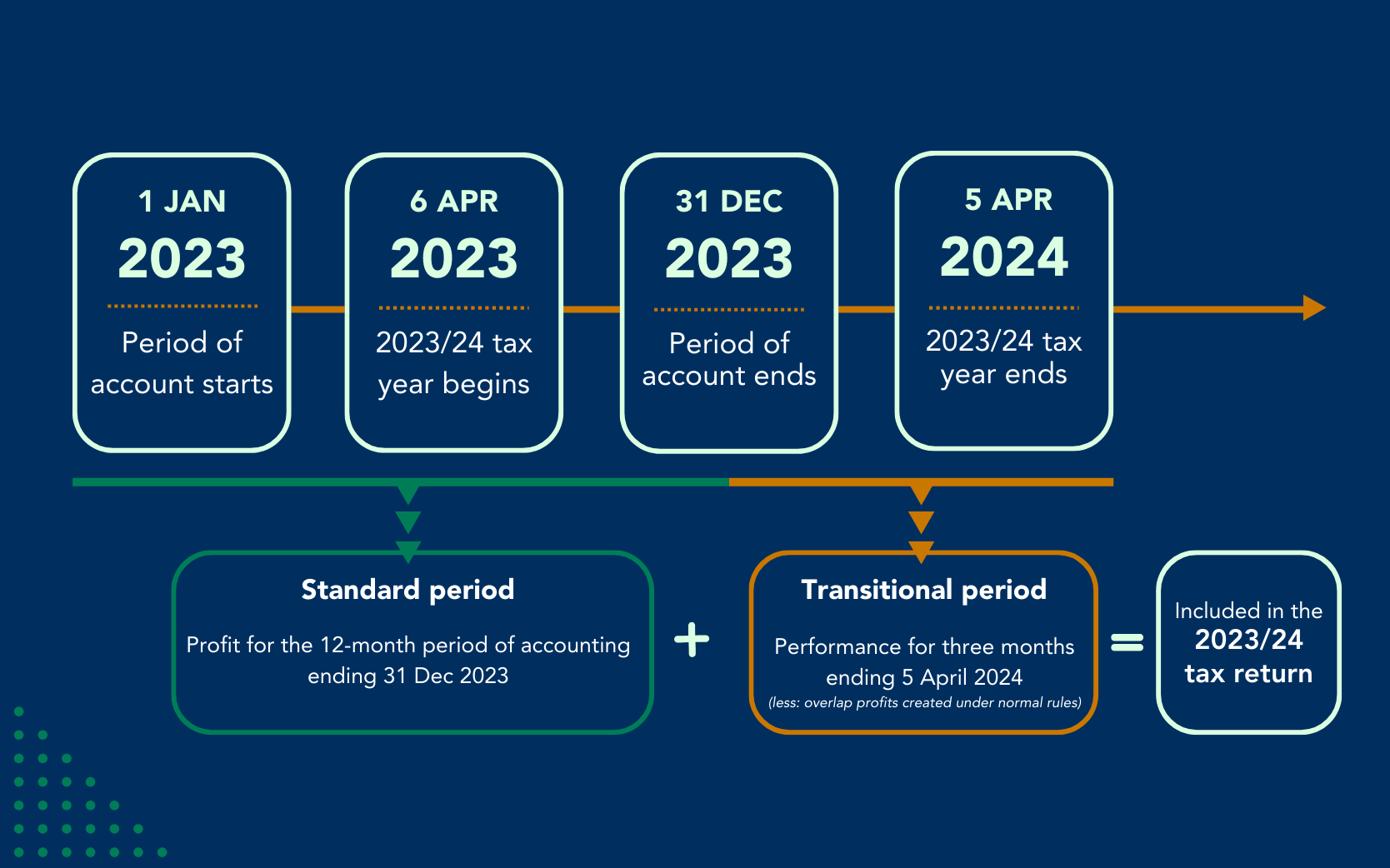

For the 2023/24 tax year, you will be taxed on your usual 12 months of profits PLUS the period that takes you to 5 April/31 March 2024 – however long that may be.

For example, if your Accounting Period usually ends on 31 December you’ll pay 15 months of profits taxable in one go – the full year, PLUS the three months that brings your accounting period in line with the tax year.

If you recognise that this has a potential extra tax burden on you, we recommend that you send your tax records in early to avoid any shock liability due in January.

Despite the additional period of profits, there is some help on the horizon with tax reliefs sliding in to reduce the tax payable. There are two sets of reliefs available. The first is ‘Overlap Relief’ which was always available to offset if a change of accounting period occurred and the second is ‘Transitional Relief’, which has been legislated for as the government imposed this change on businesses.

Step 1 – Work out Overlap Relief

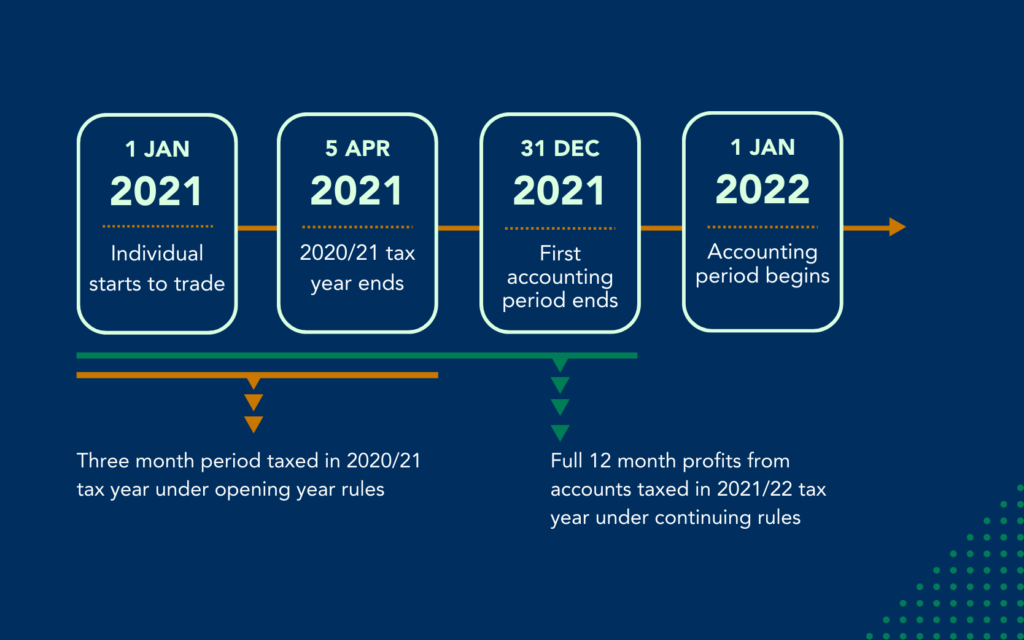

So how do you work out Overlap Relief? Let’s use our previous example, of a Sole Trader or Partnership whose accounting period ends on 31 December.

On your business startup, your first taxable profits cover the period from commencement to 5 April. The second taxable profits period covers the 12 months to the new accounting period. So, for a 31 December accounting period as you can see from the diagram below the period between commencement and 5 April ‘Overlaps’. Effectively you have been taxed twice on this 3-month period of profits. Overlap Relief allows you to deduct this duplicated set of profits once your year-end changes to 5 April.

Step 2 – Work out transition profits

The profits covering the period from the last set of accounts to 31 March/5 April less the Overlap Relief calculated is treated as the ‘Transitional Profits’ see below:

An example:

| Overlap profits | 1 January 2021 to 5 April 2021 | £10,000 |

| A/c Period Profits | 1 January 2023 to 31 December 2023 | £100,000 |

| Transitional period | 1 January 2024 to 5 April 2024 | £30,000 |

| Transitional profits calculated: | £30,000 – £10,000 = £20,000 | |

As you can see, whilst overlap relief is welcome, it is usually lower than the profits for the later period to 5 April 2024.

Step 3 – Calculate Transitional Relief over 5 year period

Based on the example above, where transition profits = £20,000, we can claim Transitional Relief by dividing this part by 5 and each 20% chunk is then added to the profits for each tax year from 2023/24.

The calculations being as follows:

| Transitional relief: | £20,000/5 | = £4,000 |

| Taxed in 2023/24 | £100,000 + £4,000 | = £104,000 |

| Taxed in 2024/25 | Profits to 5 April 2025 say £130k + £4k | = £134,000 |

This continues for the subsequent tax years until 2027/28 when all transitional profits will have been fully taxed.

So what actions do I need to take to minimise my tax position?

The above is a basic calculation, however consideration needs to be made for other issues including:

- If you cease trading, the untaxed balance will be added to cessation profits. Would this be beneficial, if retiring soon.

- Different calculations required for Farmers/Creative Averaging Relief

- If profits between two tax years are expected to be borderline between tax rate bands, it may be advantageous to NOT claim the transitional relief.

An example of the latter might look like this:

| Taxed in 2023/24 tax year: | £100,000 + £20,000 | = £120,000 without relief |

| Profit 6 April 2024 to 5 April 2025 | = £130,000 |

In 2024/25, any additional profits would be taxed at 45%. Whilst in 2023/24 they remain taxed at 40%.

By not claiming transitional relief, 5% tax is saved on the annual £4,000 profits that would otherwise have been taxed in the additional rate band in the 2024/25 tax year and potentially each subsequent tax year.

As you can see, whilst reliefs are available, the amounts involved require both calculation and consideration of future events. The best way to minimise your tax position and reduce the overall tax burden in this transitional year (and potentially the 2024/25 tax year) is to speak to your Accountant. If you need to take action in this Basis Period Reform transitional year, be prepared, seek advice now, and understand the resultant effect this will have on your tax due in January 2025.

If you’d like to discuss your position and get a plan in place – please get in touch