ProActivity spoke to Foxley Kingham Medical director and medical accountancy specialist, Zeeshan Hussain, about the risks faced by GP practices and managers which may arise from falling foul of the government’s Final Pay Control regulations.

GP practices are at risk of penalties and significant additional tax bills if they fall foul of the government’s Final Pay Control regulations. These regulations were introduced to stop a practice from awarding a pay rise to an individual just before retirement which could, in turn, falsely boost their pension fund.

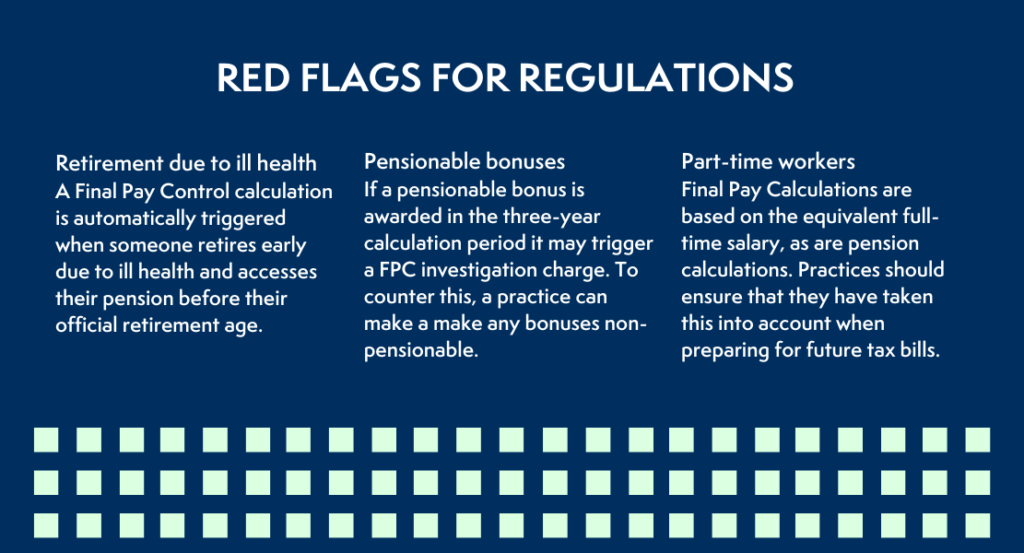

Although the regulations are designed to act as a deterrent for practices who actively set out to ‘game’ the system, there are a number of hazards that can trip up even the most well-intentioned practice management team and lead to inadvertent breaches. The most obvious red flags for practice managers are issues arising from part-time workers, pensionable bonuses, and retirement due to ill health.

One of the most important initial factors to consider when thinking about Final Pay Control regulations is the distinction between remuneration and pension systems of GPs and other practice staff, as Zeeshan Hussain, Director at FK Medical explains;

“GP pensions are calculated by looking at their income over their lifetime. Therefore, if a GP earns £10,000 or £20,000 more in the last few years of their career it does not make that much of a difference. However, with practice staff things become a bit more difficult. Their pensions are calculated on the average of last three years’ salary. So, if their salary increases just before they retire it can make a huge difference to their pension.”

The regulations, therefore, have the unfortunate consequence of making it very difficult for a practice to reward members of staff for long service with a bonus or a pay rise at the end of their career. If such an award is given, the practice could be liable for a significant tax bill years after the individual has left.

So, what is the best way to navigate the regulations? Darren Fletcher, Director at FK Medical;

“There is so much information out there. And there are a number of technical issues that can muddy the water. However, there are solutions and ways to avoid unintended breaches. The best thing to do is to talk to us. We can help put you in the best position to plan ahead.”

Zeeshan adds;

“With the pandemic, a lot of people are reconsidering retirement options, not only GPs, but all members of staff in GP practices. Leadership teams should try to get as clear an idea as possible of how their practice will be changing. By taking a proactive approach a practice can ensure that it does not trigger an unexpected tax bill or fine. This means it can fully support its staff and make retirement as straightforward as possible.”

To speak to one of the FK Medical specialists about your practice complete our quick contact form to book a free initial consultation.